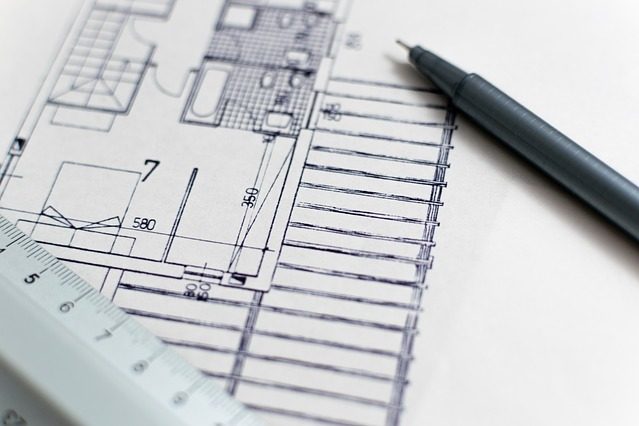

So How Do We Value Our Buy to Lets?

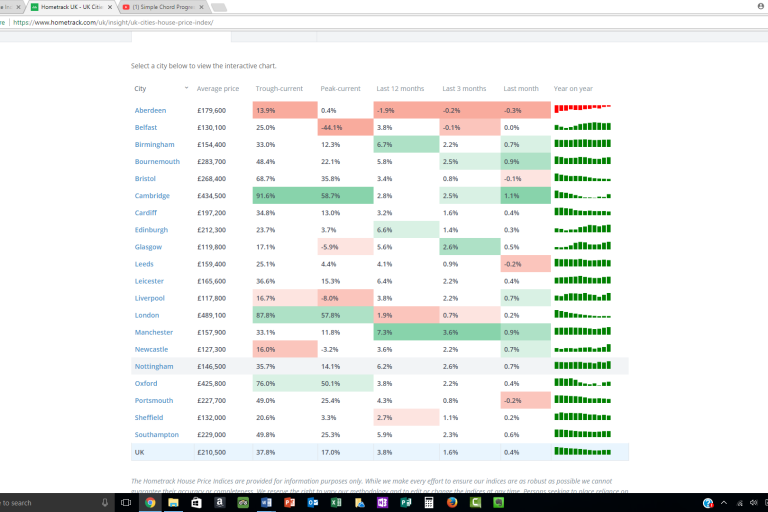

In this video we’re going to continue our mini-series on valuation, specifically the valuation of buy to let and residential investment property. In the last video we looked at some of the things which influence valuation and which we will need to take account of. If you missed that video, here’s the link. Here’s to…